Lifetime allowance

Web For 2023 the lifetime gift tax exemption as 1292 million. Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being.

Nhs England Understanding The Lifetime Allowance

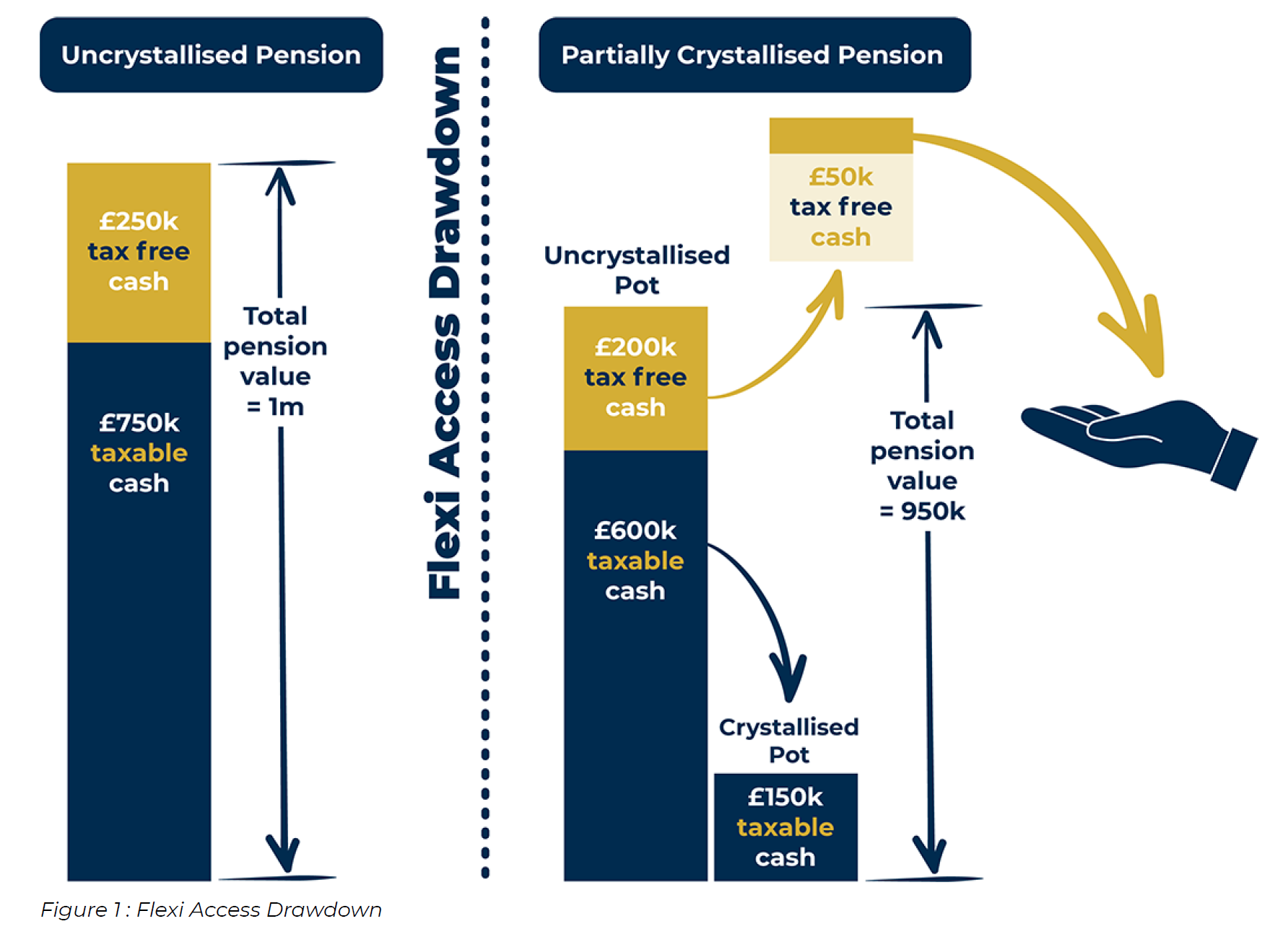

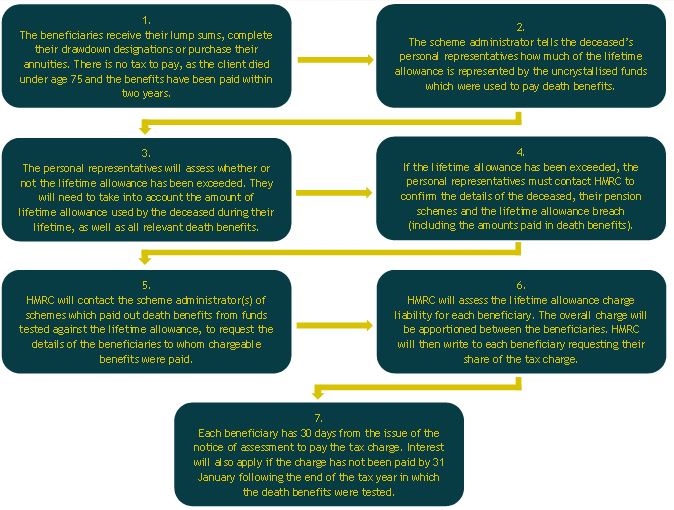

Benefits are only tested against the lifetime allowance when a benefit crystallisation event happens.

. Youll get a statement from your pension provider telling you how much. Ask your pension provider how much of your lifetime allowance youve used. General description of the measure.

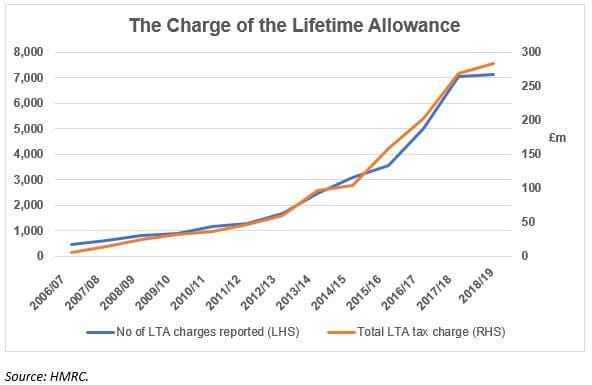

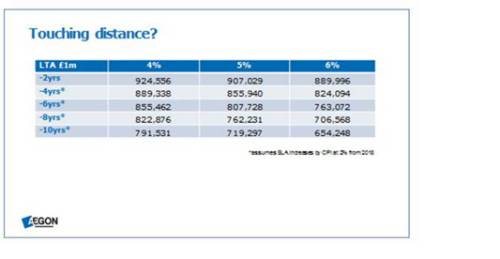

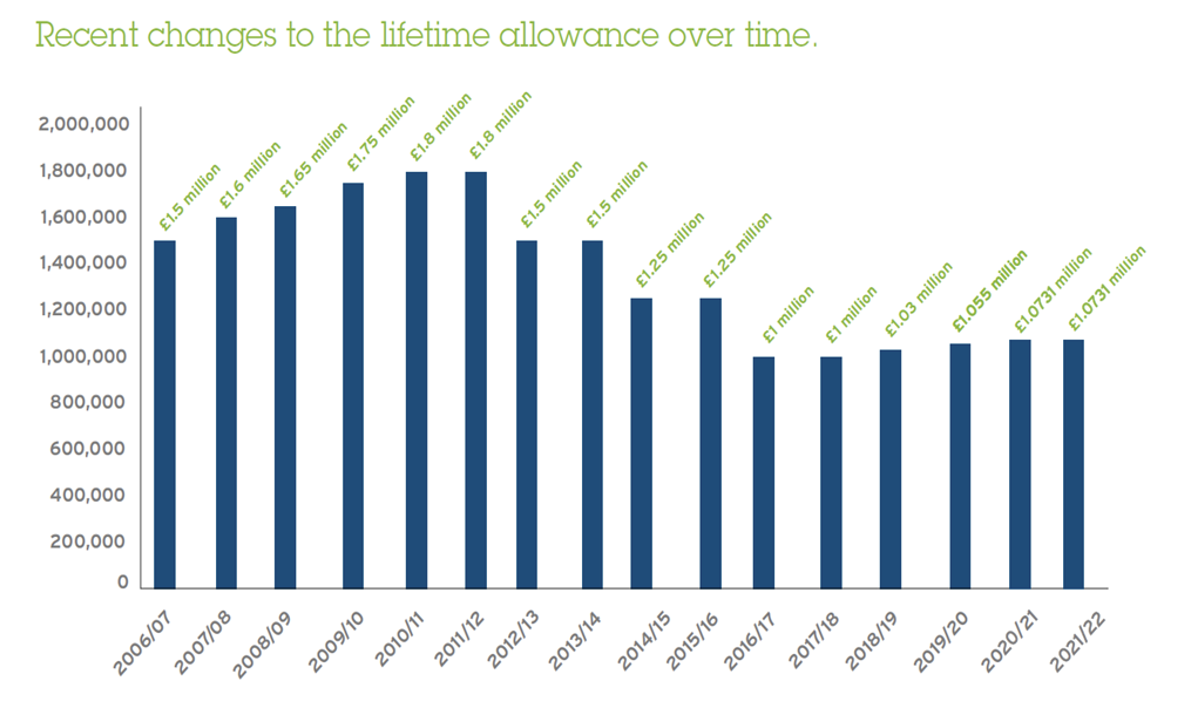

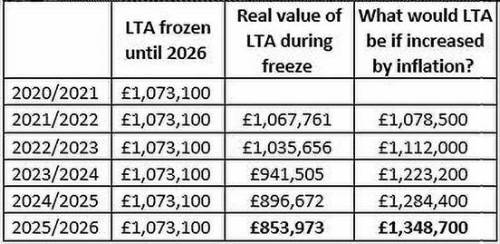

From 201819 the lifetime allowance increased every year by inflation as measured by the Consumer Prices Index rate the previous September. Protect your lifetime allowance. Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected.

It may be possible to protect benefits in excess of the lifetime. This measure removes the annual link to the Consumer Price Index increase. The current lifetime allowance is.

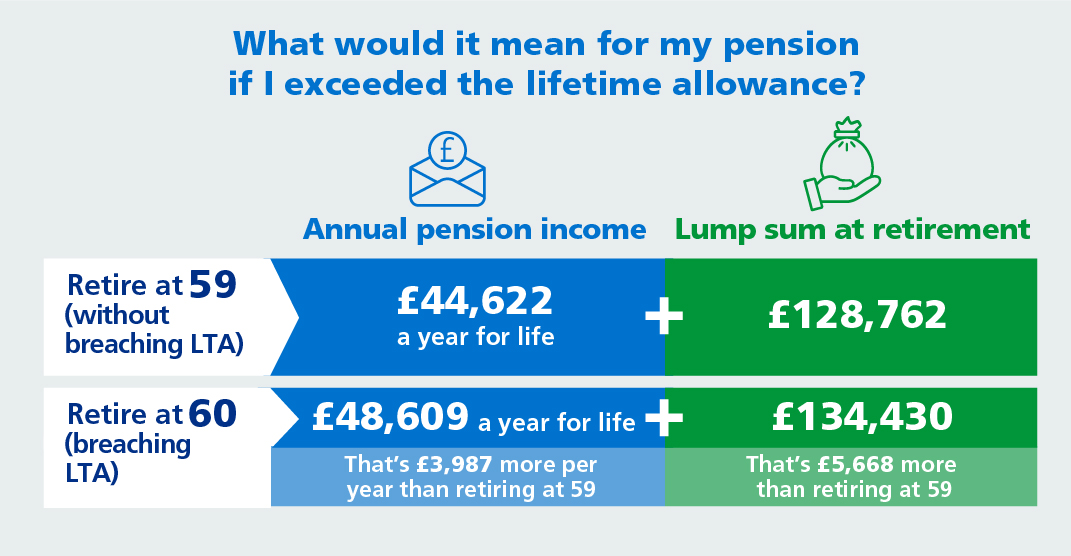

Web 1 day agoThe Lifetime Allowance penalised those who had invested diligently and sensibly during their working life and discouraged people from putting money into pensions. Web Lifetime allowance Check how much lifetime allowance youve used. Individuals whose total UK tax relieved pension savings are near to or more than.

Mr Hunt will outline his Spring Budget to Parliament on. Pay tax if you go above your lifetime allowance. For married couples both spouses get the 1292 million exemption.

Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply. Web 2 days agoCurrently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge.

Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026. Chancellor scraps lifetime allowance Chancellor Jeremy Hunt has scrapped the lifetime allowance on pension pots Reuters By Amy Austin In a shock announcement chancellor Jeremy. Web 1 day agoBudget 2023.

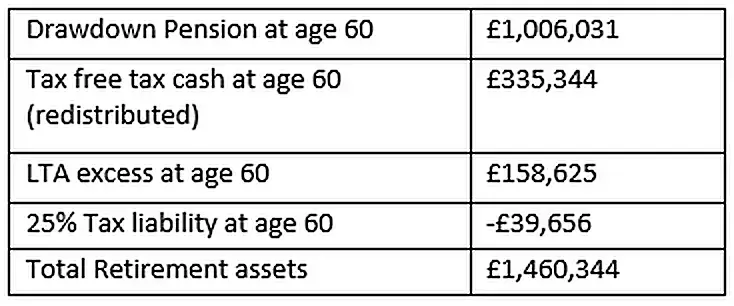

This means that you can give up to 1292 million in gifts over the course of your lifetime without ever having to pay gift tax on it. The chart below shows the history of the lifetime allowances. In addition the increase in the Annual Allowance will encourage people to put more away for their retirement.

The change removes a 55 per cent. In September 2019 inflation stood at 17. This removes that barrier.

Z5kw8dvwrqdkm

Fecia 0omtkrfm

Mfavszggeuffwm

Pension Lifetime Allowance Cuts On The Horizon Chase De Vere

Ruaz0igmqqkdom

Iap5vvuzauejlm

Paying A Lifetime Allowance Charge From Death Benefits Curtis Banks

How To Cope With The Lifetime Allowance Aj Bell Investcentre

9fvnnopwnsuggm

The Lifetime Allowance For Pensions Monevator

Do People Really Need To Be Concerned About The Pension Lifetime Allowance Right Now My Wealth

Aegon Highlights Hidden Risks Of Breaking Lifetime Allowance

D7ulr2vzccjiym

The Lifetime Allowance Back To Basics Professional Paraplanner

Understanding The Lifetime Allowance

Pension Lifetime Allowance Cuts On The Horizon

Impact Of Soaring Inflation On Pensions Lifetime Allowance