Unit of production depreciation calculator

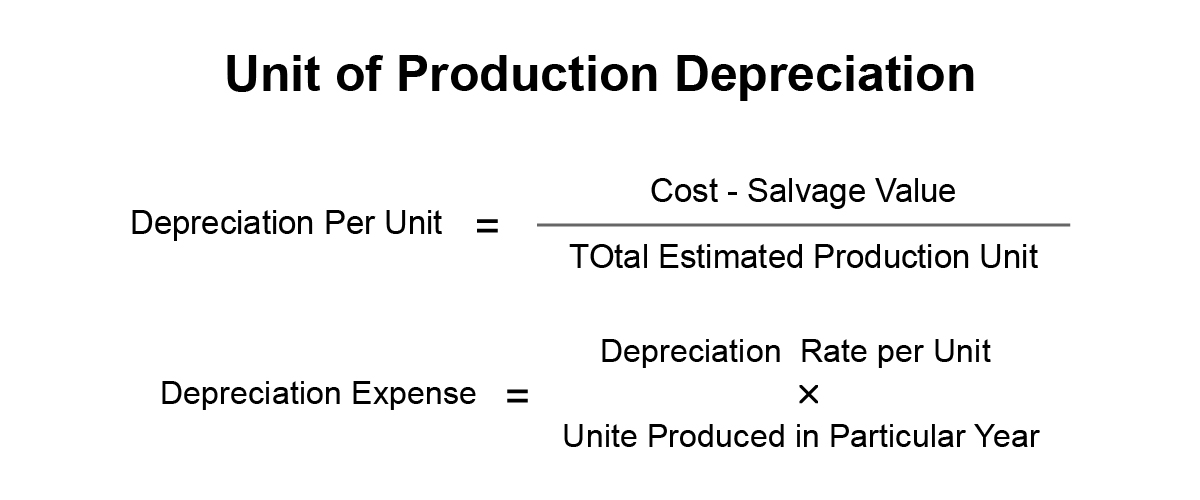

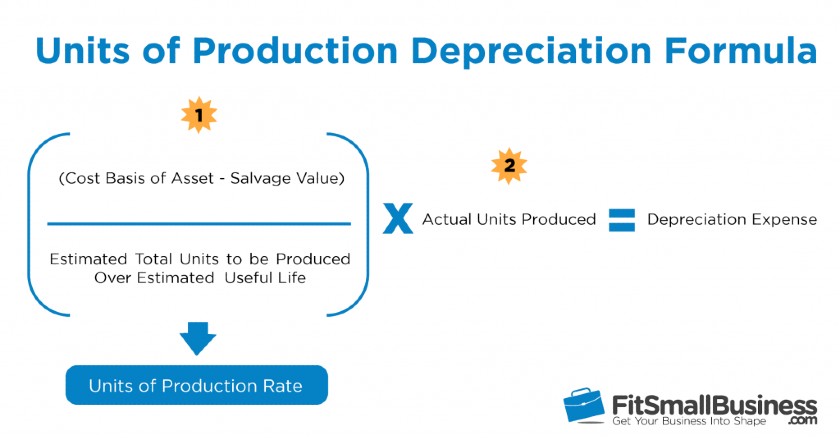

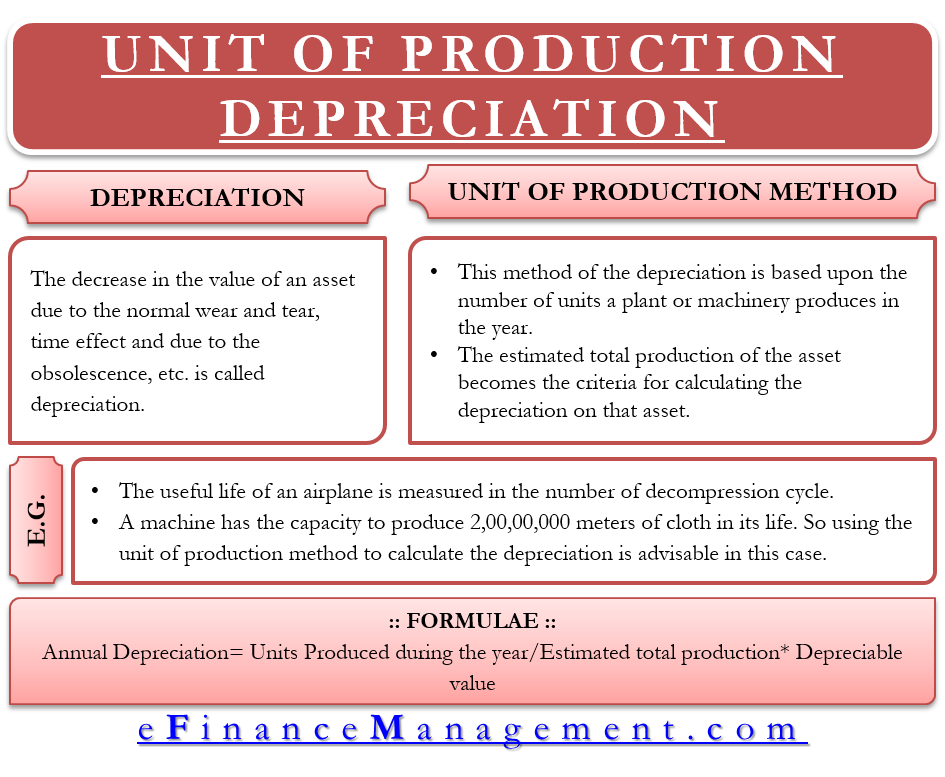

The formula used in the units of production depreciation calculator is given as follows. Units of Production Depreciation Method With this method the depreciation is expressed by the total number of units produced vs.

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

A workbook with examples of using the various.

. Units of production depreciation Cost Salvage value Expected lifetime units Full. Dividing the 480000 by the machines. Calculate the book value of a three-year-old.

Divide the assets cost minus its salvage value by the total units you estimate the equipment to generate during its useful life to compute units of production depreciation. While in the year 5 the production is at the lowest side with only 10000 units to be produced. Dividing the 480000 by the machines useful life of 240000 units the depreciation will be 2 per unit.

Sum-of-Years Digits Depreciation Calculator Calculate depreciation for any chosen period and create a sum of years digits method depreciation schedule. The total number of units that the asset can produce. Unit of Production Depreciation Formula.

Calculate the Units of Production Rate. Eg years months etc. The unit used for the period must be the same as the unit used for the life.

- 85 OFFFinancial Accounting Accelerator httpbitlyfin-acct-reviewManagerial Accou. To find the unit production rate you must know the original. If the asset will produce 200 units in its first year period the units of production depreciation value will be.

Depreciation Expense Unit Production Rate x Units Produced. This method cant apply where the machine. This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total annual depreciation for an item given the items original.

Estimated family contribution calculator 2015. And the depreciation expense is also the highest with an amount of 33600. Given the above assumptions the amount to be depreciated is 480000 500000 minus 20000.

Based on Excel formulas for SYD. For example this method could account for depreciation of a printing press for which the depreciable base is 48000 as in the straight-line method but now the number of. Accelerate Your Grades with the Accounting Student Accelerator.

Dragalia lost stat calculator. The total units can be produced by the asset is estimated as 400 units. The units of production depreciation formula is.

Unit of Production Depreciation Formula We will segregate the unit of production depreciation formula into two parts to understand it in a better way. The depreciation per unit. Units of production depreciation calculator is made to help users in the quick calculation of depreciation as per this method.

Depreciation for year 1 Unit of Production Rate x Actual Units Produced Depreciation for year 1 0081 x 20000 Depreciation for year 1 1620 So the depreciation expense for the first year.

Units Of Production Depreciation Calculator Efinancemanagement

Depreciation How It Works Examples

Definition Types Of Elasticity Of Supply Learn Economics Teaching Economics Managerial Economics

How Do I Calculate Depreciation Formula Guides Examaples

Free Online Depreciation Calculation Tool Calculator App

Depreciation Expense Calculator Flash Sales 53 Off Www Ingeniovirtual Com

Skzi1zpptvapjm

How To Calculate Minority Interest In Consolidated Balance Sheet Video Tutorial In Hindi Accounting Education Learn Accounting Balance Sheet

Depreciation Expense Calculator Discount 56 Off Www Ingeniovirtual Com

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Of Building Definition Examples How To Calculate

Unit Of Production Depreciation Method Formula Examples

Unit Of Production Depreciation Efinancemanagement

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Calculate Depreciation With Units Of Production Method Depreciation Guru

How Do I Calculate Depreciation Formula Guides Examaples

Break Even Analysis Template Business Management Degree Startup Business Plan Template Analysis